WB Student Credit Card Scheme: Student Credit Card Scheme is an initiative by the State Government of West Bengal to promote higher education among the students of the state. With the initiative, the government is distributing credit cards with a limit of up to Rs. 10 lakhs. Students can use this credit card and repay the amount in 15 Years. The rate of Interest charged on the card will be 4% annually.

Through this post, we are providing the readers with information on the WB Student Credit Card Scheme. Interested applicants can check details on the scheme in general, the application process, eligibility requirements, documents required to avail of the credit card, benefits provided and more in this post.

Contents

WB Student Credit Card Scheme 2023-Highlights

| Article Category | Scheme |

| Scheme Type | Credit Card Scheme |

| Level | State Level Scheme |

| State | West Bengal |

| Department | Department of Higher Education |

| Potential Beneficiaries | Students |

| Benefits | Credit Card loan of Rs. 10 Lakh |

| Loan Repayment Time | 15 years |

| Interest Rate | 4% per annum |

| Official Website | www.wbscc.wb.gov.in |

WB Student Credit Card Scheme 2023

The Credit Scheme was launched by the West Bengal Government on 30th June 2021. All the beneficiaries who will be registered for the scheme will get credit money for 15 years. This credit is offered in the form of a loan which the students will repay once they start earning. Thus, it will mainly help the students who are willing to pursue higher education but cannot do so due to insufficient credit.

The aim of the state government in formulating the scheme is to make the youth of the state self-reliant. The Chief Minister of the state, Ms Mamata Banerjee announced the scheme as it was a part of the election manifesto of the party. So, the government is now taking efforts into putting the scheme to work on the ground.

Features of the WB Student Credit Card Scheme

The scheme of the Student Credit Card comes along with various distinguishing features. We are listing some of these features below.

- The amount of credit promised under the scheme will be distributed to the applicants in various phases.

- Students not into formal studies and under coaching study can also get this credit card.

- The credit card provided to the students can be used for institutional and non-institutional purposes only.

- The institutional fee to be payable with the credit amount will include the Institute fee, tuition fee, course fee, etc.

- Only 30% of the loan amount will be available to use for non-institutional purposes like purchasing books, computers, courses, etc.

- All the National and Cooperative banks will be a part of the scheme and will offer a loan amount of Rs. 10 lakhs at 4% p.a.

Also Check:

WB Student Credit Card Scheme-Apply Online

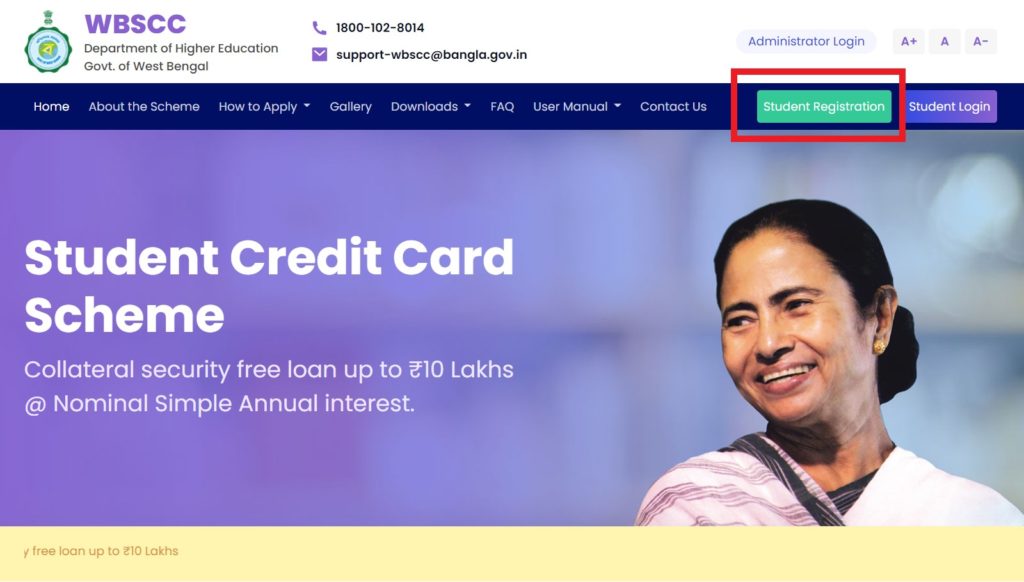

As the WB Student, Credit Card Scheme, the state government has also specified the online process to apply for the scheme. Students can apply for the scheme by visiting the official website of the authority. Students will have to first register and follow these steps to apply.

Step 1: Visit the official website of the WB Credit Card Scheme. Click on the tab of Student Registration to register on the portal.

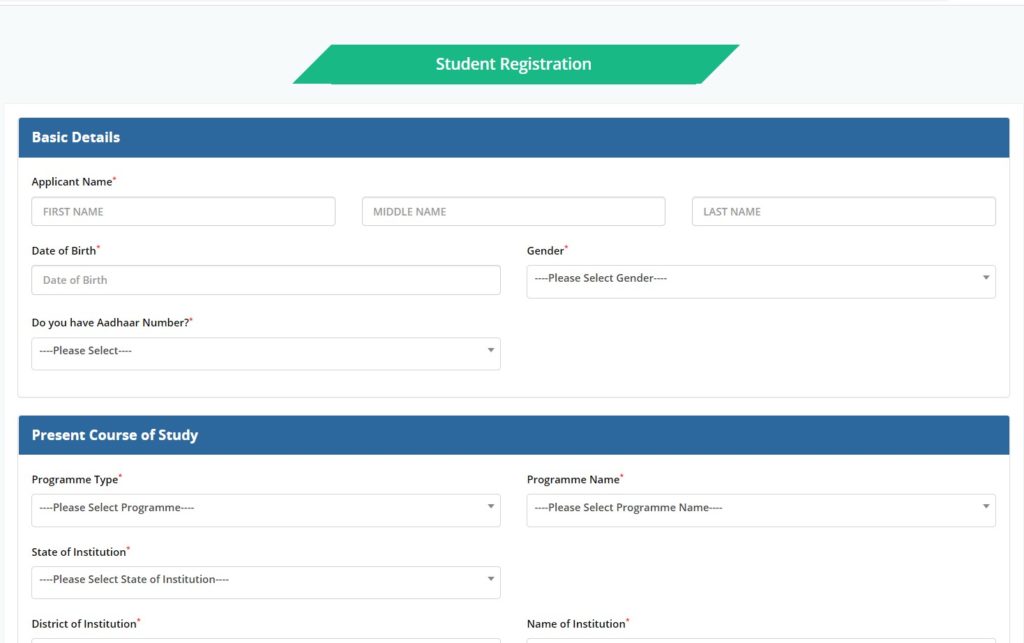

Step 2: Clicking on the tab students will be directed to the Registration page. Students will have to enter all the details present in the form including basic details, course details, contact information, password, etc.

Step 3: Inserting all the details, applicants will have to click on the Register button located on the page. You will be registered for the scheme.

Step 4: Upon registration, students will have to log in to the portal and fill out the application form, upload documents and submit the application.

Also Check:-

Documents Required

- Aadhar Card

- Photograph

- Signature

- Proof of Address

- PAN Card of the Student

- Admission Receipt

- Document detailing Course fee/ tuition fee

West Bengal Student Credit Card Eligibility Requirement

To be possible beneficiaries under the scheme, candidates will also have to fulfil some criteria of eligibility. Thus, avail of the benefits associated with the scheme. We are listing the eligibility criteria for the scheme in this section.

| Age Criteria | Applicant must be anyone less than 40 years of age. |

| Residential Criteria | The applying candidate must be a resident of the state for the past 10 years. |

| Educational Qualifications | -The government is offering this loan amount for all levels of education including undergraduate, postgraduate, Diploma, Doctoral and Postdoctoral studies. -The minimum level of education for which the loan amount will be granted is Class 10th. |

In addition to this, students who are currently studying for competitive exams in any coaching centres can also avail this credit card.

Important Links

Frequently Asked Questions

This credit card scheme is for the students to pursue their education and get a job afterwards to repay the loan amount.

Yes. Any student studying in Class 10th or above can apply for the credit card scheme and be a potential beneficiary under the scheme. The government credit of Rs. 10 lakh at a minimum rate of interest of 4%.

Yes. Students who are willing to pursue education (up to post-doctoral level) in any foreign university can also use this credit card.

The state government has rolled out the manual to apply for the scheme. Details are provided in this post.